What is a Contact Chip Card?

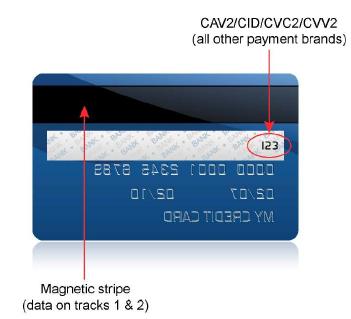

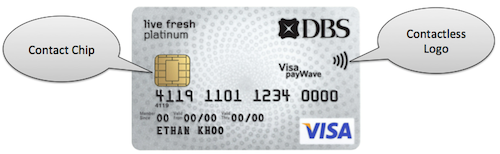

Chip cards are standard bank cards that are embedded with a micro computer chip instead of or in addition to a Magstripe. It is an evolution in our payment system that will help increase security and reduce fraud in a card-present environment. A cardholder’s confidential account data is more secure on a chip-enabled payment card than on a MagStripe card, as the former supports dynamic authentication, while the latter does not. This prevents fraudsters from easily copying account information and creating counterfeit cards.

In United States, MagStripe cards are more common-place although a migration towards chip cards is currently underway from all major card networks and Issuing banks. In UK, Chip cards, more specifically the Chip-and-PIN variety is ubiquitous while MagStripe cards are almost extinct.

This post explicitly discusses contact chip cards, which requires direct contact with the reader to establish communication with each other during a payment transaction. There is also a contactless chip card variant that we will discuss in the next post.

Contact Chip cards may come as Chip-and-PIN or Chip-and-Signature cards. Chip-And-PIN cards are used to verify the cardholder by asking them to enter a PIN during transaction authorization whereas Chip-and-Signature cards use traditional signature for cardholder verification. PIN is generally considered a more secure method of cardholder verification than Signature. But, the credit card platform in United States is not built to support PIN. So, you would generally see only Chip-and-Signature cards in US.

Mobile Payments Blog Series

Welcome to the Mobile payments FAQ and not so FAQ series and you are on FAQ #6. The idea behind this series is to share and learn as much as possible about the field of mobile payments. If you like, you can read all of the FAQs on the Mobile Payments category or by visiting the Table of contents page.